With the Communiqué on Principles Regarding Companies Whose Shares Will Be Traded on the Venture Capital Market [II-16.3] [“Communiqué”] published in the Official Gazette on 18.5.2023, the procedures and principles regarding the sale of non-public joint stock companies to qualified investors for trading in the stock exchange came into effect.

Banking & Finance in Turkey

Contributed by Guleryuz & Partners.

Cansu Telli Joins SST Technology as Legal Counsel

Cansu Telli has joined SST Technology as Legal Counsel in Turkey.

Aksan Advises Simya on Werover Investment

The Aksan Law Firm has advised Simya VC on its investment in Werover, in a USD 400,000 round that also included angel investors Semiramis Kulak and Arman Koklu.

Dogukan Berk Aksoy and Ece Alkan Make Partner at Yetkin Attorneys at Law

Former Counsel Dogukan Berk Aksoy and former Senior Lawyer Ece Alkan have both been promoted to Partner with Yetkin Attorneys at Law in Ankara.

Sadik & Sadik Changes Name to Sadik & Capan with Addition of Nazli Tonuk Capan

Sadik & Sadik has changed its name to Sadik & Capan with the addition of Nazli Tonuk Capan as Co-Managing Partner.

Aksan Advises Maxis and Founder One on Argedu Investment

The Aksan Law Firm has advised portfolio manager Maxis and venture capital fund Founder One on their investment in Istanbul-based online education company Argedu.

Allen & Overy and Shearman & Sterling Announce Merger to Create Allen Overy Shearman Sterling

On May 21, 2023, Allen & Overy and Shearman & Sterling announced they are merging into a fully integrated firm: Allen Overy Shearman Sterling – A&O Shearman for short.

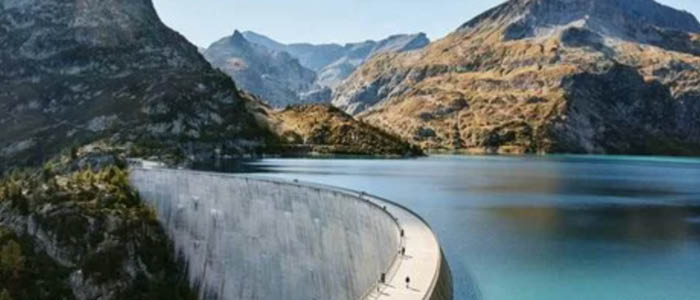

Paksoy Advises EBRD on USD 110 Million Loan to Enerjisa Uretim

Paksoy has advised the EBRD on its USD 110 million loan to Enerjisa Uretim.

Capital Markets in Turkey

Contributed by Kolcuoglu Demirkan Kocakli.

Schoenherr and Freshfields Advise on EUR 1.4 Billion Sale of Cargo-Partner Subsidiaries to Nippon Express

Schoenherr, working with Luther and Hogan Lovells, has advised the Cargo-Partner Group Holding on its EUR 1.4 billion sale of Cargo-Partner GmbH and 60 other subsidiaries to Nippon Express Holdings. Freshfields Bruckhaus Deringer advised the buyer.

Aksan Advises APY Ventures on Investment in Saha Robotik

The Aksan Law Firm has advised APY Ventures on its investment in Turkish autonomous robot developer Saha Robotik.

BASEAK Advises on Buyutech Investment

Dentons Turkish affiliate Balcioglu Selcuk Ardiyok Keki Attorney Partnership has advised APY Ventures' Bilisim Vadisi Venture Capital Fund and Ostim Venture Capital Fund on their investment in Buyutech.

Omer Erdogan Joins Kinstellar in Istanbul as Partner

Former Guner Law Office Partner Omer Erdogan has joined Kinstellar Turkish affiliate Gen & Temizer Ozer as a Partner in Istanbul.

M&A Series III: Due Diligence Review and Its Consequences on Seller’s Liability

Due diligence review, which is frequent in acquisition transactions, basically refers to an examination of the target company prior to the buyer's acquisition. This term originates from Anglo-American legal system, and Swiss-Turkish doctrine has yet to generate a new term and thus uses the term “due diligence” in their legal terminology.

Esin and ODSA Advise on Sale of Groupama Investment Bosphorus Holding to AXA

Baker McKenzie Turkish affiliate Esin Attorney Partnership has advised Groupama Assurances Mutuelles on the sale of Groupama Investment Bosphorus Holding to AXA Mediterranean Holding. Gide Turkish affiliate Ozdirekcan Dundar Senocak advised the buyer.

Commercial Disputes Gain Momentum in Turkey: A Buzz Interview with Demet Kasarcioglu of Esin Attorney Partnership

As the country quickly approaches the end of another election cycle, there appears to be an increase in litigation proceedings in Turkey – at least when it comes to the M&A and construction sectors – according to Esin Attorney Partnership Partner Demet Kasarcioglu.

Gonca Sonmez Uyguc Appointed to Senior Director at Takeda

Takeda has appointed former Dubai-based Head of Ethics & Compliance, ICMEA Gonca Sonmez Uyguc to Senior Director in Istanbul.