Capital Markets Board of Turkey [the "Board"] released a public press on February 1, 2021 regarding the issuance of the Draft Communiqué Amending the Communiqué on Tender Offers No. II-26.1 [the "Draft Amendment”] which envisages to make certain amendments to the Communiqué on Tender Offer No. II-26.1 [the "Communiqué"]. In this respect, while some existing provisions will be clarified with the Draft Amendment, the scope of the circumstances which do not trigger the tender offer obligation and the exceptions to mandatory offers will be expanded.

New Era in Trials: Procedures and Principles to Attend Hearings Through Audio and Video Transmission Are Regulated

The "Regulation on the Conduct of Trials by Audio and Video Transmission in Civil Procedures" ["Regulation"] was published in the Official Gazette dated 30 June 2021 numbered 31527 and entered into force on the same date. The Regulation sets out the procedures of e-hearings, which have become more important due to the Covid-19 pandemic. According to Regulation, e-hearings will have the same legal consequences with the physical hearings.

Mandatory Mediation: An Obstacle to Access to Justice?

Mediation is essentially a dispute resolution method; and an ancient institution throughout the history of mankind that is traditionally recognized in almost all societies. Instead of bringing an action before court; by applying mediation, the disputing groups [i.e., the villagers, townsfolk or members of a profession] discuss the issue with the assistance of a third person, and that third person assists parties in reaching a settlement. In this conventional system based on the fundamental principle of freedom of will, mediation is perceived to be an “alternative” dispute resolution method free from the coercive power of state. Such situation similarly appears in the settlement of disputes between the states.

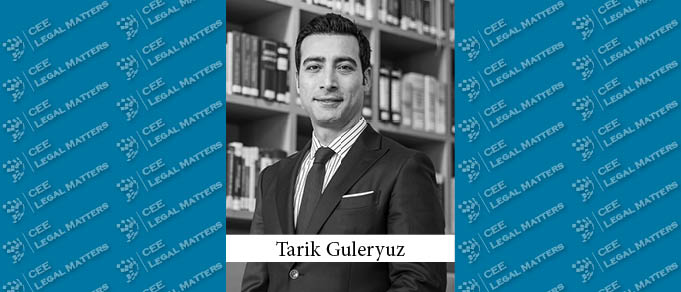

Hot Practice: Tarik Guleryuz on Guleryuz & Partners' Litigation & Disputes Practice

Debt collection cases, driven by the ongoing currency crisis in Turkey, as well as shareholder and other partnership disputes, have been the main focus of the Guleryuz & Partners law firm of late, according to Partner Tarik Guleryuz.

Taxpayers Holding Cross-border Financial Assets Must Be Careful: International Exchange of Information is Gaining Momentum

It is a fact that international transactions - despite global disasters such as the Covid19 pandemic - continue inevitably and without slowing down. Hence, the scope of information exchange between countries on the assets of citizens and residents is also expanding, in order to ensure that the taxes are paid in the right amount to the right jurisdiction. Information exchange between countries matter not only for dual citizens but also for people who profit or make investments overseas.

Amendments to the Execution and Bankruptcy Law: It is Now Possible to Sell Businesses as a Whole

On June 19, 2021, the Law No. 7327 Amending the Execution and Bankruptcy Law and Some Other Laws [“Amendment Law”] was published in the Official Gazette, and accordingly, significant amendments have been introduced to the Execution and Bankruptcy Law [“EBL”]. This client alert aims to outline these amendments.

A Growing Trend: Representations & Warranties Insurance on Cross-Border Deals

The use of representation and warranty insurance, also known as M&A insurance and warranty and indemnity insurance [“R&W Insurance”], has grown in recent years to the stage where it has now become a standard feature of the cross- border M&A landscape. Estimates suggest that in the United States, the product was used in around 50% of the private acquisitions last year. Also, statistics pertaining to the year of 2019 indicate that the R&W Insurance was purchased in 49% of large deals having a value more than 100 million Euros in the European market. As is seen, R&W Insurance is frequently being used in M&A transactions and, in many respects, is now a mainstream.

New Obligation of Shareholders Holding Bearer Shares in Turkish Companies

The government announced a substantial change in bearer shares at the end of 2020, but the details were only finalised in April 2021. According to the new amendment, non-public joint stock companies are now obliged to register shareholders holding bearer shares.

Merve Oney Barlas Hired as Chief Legal Officer at DgPays

Merve Oney Barlas has joined Istanbul-based financial services provider DgPays as Chief Legal Officer.

Non-payment of Capital Contribution in Joint-stock Companies: The Forfeiture Procedure under Turkish Law

Capital commitment is one of the indispensable conditions for becoming a shareholder in a Turkish joint-stock company ("JSC"). Under Turkish law, the main responsibility of a shareholder, whether in the stage of incorporation or capital increase, is to pay the undertaken capital.

Turkey’s Transportation Leap and the 1915 Canakkale Bridge and Highway Project

Strong investments in the Turkish infrastructure sector have been the driving force behind Turkey’s economic development. In the last decade, several investments referred to as “mega-projects” have gained much attention, such as the completed Eurasian Tunnel in Istanbul, a road transport tunnel running under the Bosphorus to connect the European and Asian sides of Istanbul; the new Istanbul Airport, increasing capacity from over 100 million to over 200 million passengers per year; the third Istanbul Bridge, still one of the largest projects with construction costs of around TRY 4.5 billion (although it fell short of expectations and required USD 2.7 billion in refinancing from ICBC and still could not be executed due to the pandemic). One of the most recent projects is the 1915 Canakkale Bridge and Highway Project.

Real Estate Goes Green in Turkey

Turkey continues to prioritize the adoption and consistent implementation of sustainability principles throughout its economy. Indeed, the Turkish Capital Markets Board recently set a voluntary threshold for companies subject to its supervision, and many are finding the use of green buildings valuable in reaching them. In addition to their economic benefits, green buildings – which are socially and environmentally compatible with their environment – are gaining importance in determining a company’s level of sustainability credibility and sustainable investment commitment.

An Unusual Year in Review: Our Annual Expert Round Table

On December 15, 2020 CEELM gathered legal experts from across the region for its annual Year-in-Review Round Table conversation. In a wide-ranging discussion, participants shared opinions and perspectives on their markets, on strong (and less-strong) practices across the region, and the effect of the COVID-19 crisis on both, as well as on how technology is changing the legal industry, and what the industry will look like in 2021.

Marketing Law Firm Marketing: Most Valuable Software Tool

New technologies are all the rage, as law firms adapt to the telecommuting and digitalization realities that accompanied the Covid-19 pandemic. Accordingly, we decided to ask our Law Firm Marketing experts from across the region a simple question: “What is the single most important/valuable piece of software you use?” As always, we asked respondents to focus on the question at hand, rather than – as we put it – using the question simply as an excuse to “tell us that their firms are awesome.” Not everyone was able to resist.

Turkey: New Instruments in Debt Capital Markets – Secured Debt Instruments and The Security Agent

2020 was a busy year for the legislator in relation to the Turkish Capital Markets. An amendment made in the Turkish Capital Markets Law (CML) at the beginning of 2020 introduced several elements, including a Security Agent, into Turkish law. And then the pandemic hit, making the trust factor in regard to assets even more crucial than it was before. In times of uncertainty, the Security Agent may be invited to play a greater role.

Turkey Introduces New Transfer Pricing Documentation Rules In Line with BEPS Action Plans

In 2015 the Organization for Economic Cooperation and Development created 15 base erosion and profit shifting (BEPS) action plans to equip governments to address tax avoidance by means of domestic and international rules and instruments. The purpose of the action plans is to ensure that profits are taxed where economic activities generating the profits are performed and where value is created.

Expat on the Market: Interview with Stephanie Beghe Sonmez of Paksoy

An interview with Stephanie Beghe Sonmez of Paksoy, about her path from France to Turkey.

Inside Out: Turkey’s First Unicorn

On June 3, 2020, CEE Legal Matters reported that White & Case and its associated Turkish firm, GKC Partners, had advised interactive entertainment company Zynga Inc. on its USD 1.8 billion acquisition of Istanbul-based mobile gaming company Peak Oyun Yazilim ve Pazarlama, A.S. Baker McKenzie, working with its Turkish affiliate, the Esin Attorney Partnership, advised Peak on the transaction, which represented the largest acquisition of a start-up in Turkey to date, and makes Peak the country’s first “unicorn.” Dentons, along with its affiliate Balcioglu Selcuk Ardiyok Keki Avukatlik Ortakligi, advised selling shareholder Hummingbird Ventures CVA, Abcoo advised Peak Founder and CEO Sidar Sahin, the Verdi Law Firm advised selling shareholders Earlybird Verwaltungs GmbH, Evren Ucok, and Demet Suzan Mutlu Ucok, and BTS & Partners advised selling shareholder Endeavour Catalyst.