Kyriakides Georgopoulos has advised the Ioannou Family and Donkey Hotels & Resorts on their partnership with funds managed by Azora Gestion.

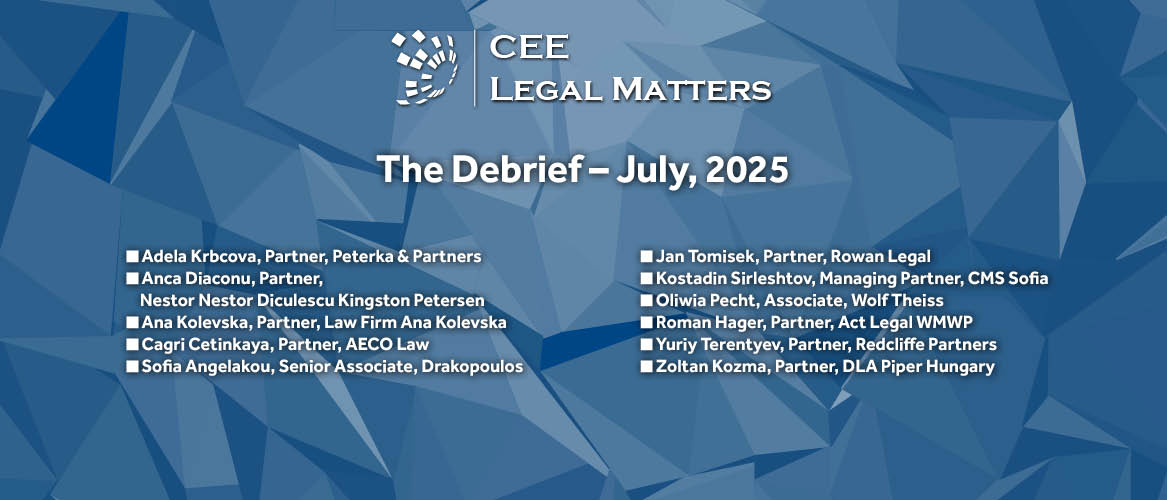

The Debrief: July 2025

In The Debrief, our Practice Leaders across CEE share updates on recent and upcoming legislation, consider the impact of recent court decisions, showcase landmark projects, and keep our readers apprised of the latest developments impacting their respective practice areas.

KG Advises Petsiavas on Acquisition of ABC Kinitrin’s Oral and Dental Care Business

Kyriakides Georgopoulos has advised Petsiavas on its acquisition of the oral and dental care business of ABC Kinitron.

Sotiris Dempegiotis Joins Calavros Law Firm as Partner

Former Lambadarios Partner Sotiris Dempegiotis has joined Calavros Law Firm as Partner and Deputy Head of the International Arbitration Department.

Alexios Andriopoulos Joins Welcome Pickups as Head of Legal & Compliance

Alexios Andriopoulos has joined Welcome Pickups as the company's new Head of Legal & Compliance.

Greece Rides the Wave: A Buzz Interview with Kostas Fatsis of AKL

Greece continues to ride a wave of investment interest, with momentum building across real estate, hospitality, renewables, and increasingly, digital infrastructure, according to AKL Partner Kostas Fatsis, who walks us through the latest legislative developments shaping the market, including energy reforms, FDI screening, and judicial modernization.

Papapolitis & Papapolitis and Bernitsas Advise on Dukes Education's Acquisition of Mandoulides Schools in Greece

Papapolitis & Papapolitis has advised UK-based Dukes Education on its acquisition of Mandoulides Schools from Mandoulides Holding Societe Anonyme. Bernitsas advised the sellers.

Bernitsas Advises Piraeus Bank on EUR 500 Million Green Notes Offering

Bernitsas has advised Piraeus Bank on the issuance and offering of EUR 500 million green senior preferred notes due 2028, targeting both international and Greek institutional investors.

Anagnostopoulos Defends Former Werfen Hellas Director in Healthcare Fraud Case

Anagnostopoulos has successfully represented a former director of Werfen Hellas before the Athens Criminal Court, which cleared the defendant of healthcare fraud charges related to product pricing practices for healthcare organizations.

KG Advises Frigoglass SAIC on Acquisition of Provisiona Iberia and Serlusa Refrigerantes

Kyriakides Georgopoulos has advised Frigoglass SAIC on its EUR 10.2 million cross-border acquisition of Provisiona Iberia and Serlusa Refrigerantes, based in Spain and Portugal, respectively.

FNG Law Firm Joins Drakopoulos

Greece-based FNG Law Firm has joined Drakopoulos with Petros Fragkiskos and Konstantinos Nikolakopoulos Giannidis becoming Drakopoulos Equity Partners and Achilleas Papadopoulos joining as Partner.

Koutalidis Advises ABO Energy on Sale of Greek RES Portfolio to Helleniq Renewables

Koutalidis has advised ABO Energy on the sale of ABO Hellas, along with six affiliated entities and a 1.5-gigawatt renewable energy portfolio, to Helleniq Renewables.

Bernitsas Advises Vivartia Group on Sale of Dodoni to Hellenic Dairies

Bernitsas has advised the Vivartia Group on the sale of 100% of its shares in Dodoni, held through Nutrico, to Hellenic Dairies.

George Alexandris Makes Partner at Bahas, Gramatidis & Partners

Bahas, Gramatidis & Partners has promoted George Alexandris to Partner.

Bernitsas Advises Piraeus Bank on EUR 200 Million Private Securitization of Car Lease Receivables by Avis Budget Greece

Bernitsas has advised Piraeus Bank as the senior loan noteholder and senior facility agent on a EUR 200 million private securitization of car lease receivables originated by Olympic Commercial and Tourist Enterprises Single Member.

Koutalidis Advises Alpha Bank on Reverse Merger and Share Listing

Koutalidis has advised Alpha Bank on its successful reverse merger by absorption of its parent entity Alpha Services and Holdings, and the subsequent listing of Alpha Bank’s new shares on the Main Market of the Athens Exchange.

KG and Papapolitis & Papapolitis Advise on Bally’s EUR 2.7 Sale of International Interactive Business to Intralot

Kyriakides Georgopoulos has advised Bally’s Corporation on its EUR 2.7 billion sale of its International Interactive Business to Intralot. Papapolitis & Papapolitis advised Intralot.

Bernitsas Advises Attica Bank on EUR 1 Billion EMTN Program and Dual Note Issuance

Bernitsas has advised Attica Bank on the establishment of a EUR 1 billion medium-term note Program and the subsequent issuance of EUR 100 million additional tier 1 notes and EUR 150 million tier 2 subordinated notes.