Latest News By Country

This summer, the Albanian National Assembly adopted a significant package of amendments to the Law on Foreigners, signalling a clear shift toward aligning national migration rules with key EU directives. While the legal changes are substantial, their purpose is broader: to simplify how Albania governs entry, residence, and work rights for foreign nationals, especially those from the European Union. The reform reflects both Albania’s political will to approximate the EU acquis and a growing recognition that the country must adapt to new demographic, labour, and mobility dynamics. While the amendments cover a wide range of areas, we highlight below the provisions most likely to impact foreign nationals and their interactions with Albanian institutions.

On 03.07.2025, the Albanian Parliament approved Law No. 56/2025, adding a new provision to Law No. 7764, dated 02.11.1993, “On Foreign Investments”, as amended. This law was published in the Official Gazette on 11.07.2025.

In a significant development for the personal data protection landscape in Albania, the Council of Ministers has adopted Decision No. 347, dated 19 June 2025, establishing a new state database titled “Electronic Registry of Data Protection Officers” (DPO Registry). This marks a major milestone in the country’s efforts to align its data governance infrastructure with international and European standards, in line with the newly reformed legal framework on personal data protection.

The Federal Administrative Court (BVwG) has, for the first time, addressed the question of whether the EU Nature Restoration Regulation (NRR) applies in permitting procedures (BVwG 9 May 2025, W270 2279107-1).

CMS, working with Ashurst, has advised Renalfa IPP on the development of its EUR 1.2 billion investment program in photovoltaic, battery electricity storage systems, and wind projects across Bulgaria, Hungary, North Macedonia, and Romania. The firm also advised on securing a EUR 315 million club loan facility led by the EBRD and backed by an InvestEU loss guarantee. DGKV, and reportedly A&O Sherman and PHH, advised the lenders.

Freshfields Bruckhaus Deringer has advised Ams OSRAM on the sale of its Entertainment and Industry Lamps business to Ushio.

The commercial legal markets of Central & Eastern Europe didn’t appear automatically. They didn’t develop in a vacuum. They were formed, shaped, and led, by lawyers – visionary, hard-working, commercially-minded, and client-focused individuals pulling the development of CEE’s legal markets along behind them as they labored relentlessly for their clients, their careers, their futures.

CMS, working with Clifford Chance, has advised UniCredit Group and Zagrebacka Banka on the EUR 550 million debt refinancing granted to Fortenova Grupa. King & Spalding reportedly advised Fortenova Grupa.

Gecic Law has successfully represented Arena Channels Group, alongside BH Telecom and Mtel Banja Luka, in an antitrust dispute before the Court of Bosnia and Herzegovina.

In The Corner Office, we ask Managing Partners at law firms across Central and Eastern Europe about their backgrounds, strategies, and responsibilities. This time around, we asked: For 2025, what is the one sector or industry in the country that shows the most promise for growth, and why?

The adoption of The Personal Bankruptcy Act ( the“Act“), published in the State Gazette, issue 54 of July 4, 2025, marks a significant milestone in the development of Bulgarian law. This legislative act fills a long-standing gap in the national legal framework, as Bulgaria was until recently the only European Union member state without comprehensive personal insolvency legislation. This lack has led to serious social and economic difficulties for citizens burdened with unmanageable debts, who often find themselves in a permanent state of inability to repay them.

According to the Bulgarian–Turkish Chamber of Commerce and Industry (BULTİŞAD), as of August 2023, Turkish investments in Bulgaria have reached approximately €2.5 billion, generating over 15,000 jobs through more than 70 production facilities and 2,500 active companies[1].

Wolf Theiss has advised Raiffeisen Bank International on a non-recourse project financing facility to support the development of three photovoltaic power plants in Bulgaria.

CMS, working with Clifford Chance, has advised UniCredit Group and Zagrebacka Banka on the EUR 550 million debt refinancing granted to Fortenova Grupa. King & Spalding reportedly advised Fortenova Grupa.

Divjak Topic Bahtijarevic & Krka has advised Signalinea owner Marko Dovgan on the sale of the company to Saferoad Group. Wahl advised the buyers.

Stijacic Sostaric has advised Vacom founder and seller Igor Valentic on an investment from SQ Capital. Pavlicek Ergarac Medved advised SQ Capital.

EU Member States are required to transpose the European Consumer Credit Directive (CCD 2), effective since October 2023, into national legislation by November 2025, with the new regulations expected to come into force on 20 November 2026. The CCD 2 aims to harmonise the fragmented regulations across Member States, eliminate legal uncertainty surrounding new credit products and strengthen consumer protection.

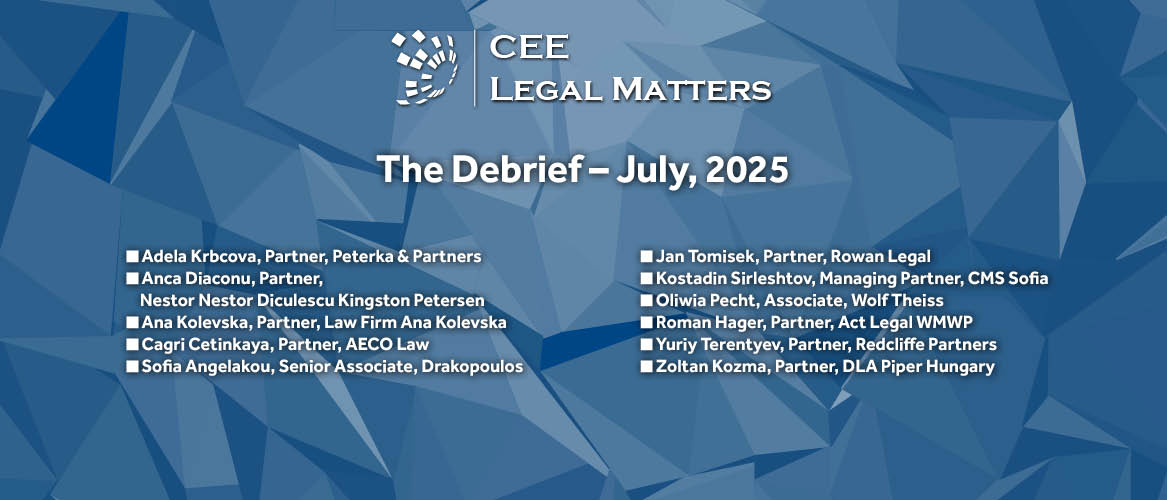

In The Debrief, our Practice Leaders across CEE share updates on recent and upcoming legislation, consider the impact of recent court decisions, showcase landmark projects, and keep our readers apprised of the latest developments impacting their respective practice areas.

Glatzova & Co, working with Monereo Meyer Abogados, has advised Rouvy on its acquisition of Spanish company Bkool.

In The Debrief, our Practice Leaders across CEE share updates on recent and upcoming legislation, consider the impact of recent court decisions, showcase landmark projects, and keep our readers apprised of the latest developments impacting their respective practice areas.

Kyriakides Georgopoulos has advised Petsiavas on its acquisition of the oral and dental care business of ABC Kinitron.

Former Lambadarios Partner Sotiris Dempegiotis has joined Calavros Law Firm as Partner and Deputy Head of the International Arbitration Department.

According to Regulation 2025/40 of the European Parliament and the Council on packaging and packaging waste, starting from 1 January 2029, only non-profit organizations will be allowed to operate mandatory deposit return systems (DRS) for beverage packaging. Currently, in Hungary, this system is fully operated by MOHU MOL Hulladékgazdálkodási Zrt. (MOHU).

This article is part of a series presenting selected amendments introduced by Act XLIX of 2025 on the amendment of laws concerning the judiciary (hereinafter the "Act"), which significantly affect civil litigation in several respects.

CMS, working with Ashurst, has advised Renalfa IPP on the development of its EUR 1.2 billion investment program in photovoltaic, battery electricity storage systems, and wind projects across Bulgaria, Hungary, North Macedonia, and Romania. The firm also advised on securing a EUR 315 million club loan facility led by the EBRD and backed by an InvestEU loss guarantee. DGKV, and reportedly A&O Sherman and PHH, advised the lenders.

Ellex has advised Vok Bikes on its USD 6 million series A funding round led by SQM Lithium Ventures. Sorainen, working with DLA Piper, reportedly advised SQM.

Cobalt has advised Hanza on its acquisition of Milectria Group from Milectria Group Oy, Tomi Kaukonen, Juha-Matti Kaukonen, Mirka Ruoho, and Tatu Piilola. Njord, working with Applex, advised the sellers.

Pohla & Hallmagi has advised GRK Estonia on its acquisition of A-Kaabel from its shareholders. Eversheds Sutherland advised the sellers.

Kosovo’s shift to a liberalized energy market has prompted business pushback, with courts stepping in to ensure stability as companies navigate rising costs, limited suppliers, and a lack of clear regulatory guidance, according to Lex Business Managing Partner Vjosa Shkodra.

Kosovo is in political limbo after the February elections, with stalled government formation affecting key decisions, according to Ardian Rexha, an Attorney at Law associated with Deloitte Kosova. At the same time, energy reforms and price hikes by the regulator are causing strong reactions from businesses and the public.

Kosovo is accelerating its energy transition, SEPA integration, and corporate transparency, aligning with EU standards to boost investment, competition, and economic stability, according to Nallbani Law Office Managing Partner Delvina Nallbani.

Ellex has advised Sweden-based Hansas Property Holding on the sale of its Latvian subsidiary Hanzas Park to Twelve.

Ellex has advised Norway-based Orkla Eiendom and Latvia-based Orkla Latvija on Orkla Eiendom 's acquisition of Latvian real estate companies Artilerijas 55 and Miera 22 from Orkla Latvija.

Sorainen has advised Entrum on its EUR 15 million bond issue program, which saw its first tranche raise EUR 2.5 million from investors.

Ellex has advised Gemoss on its acquisition of Sangaida. Noor advised the sellers.

Ellex has advised Sakalas on the acquisition of Futurus Food.

Sweeping tax reform, corporate governance, and procurement regulation updates have been the main legislative developments in Lithuania this year, according to Widen Partner Aiste Mikociuniene. While some of the changes bring modernization and new incentives, Mikociuniene warns that increased burdens and uncertainties could weigh heavily on businesses and legal professionals alike.

CMS, working with Ashurst, has advised Renalfa IPP on the development of its EUR 1.2 billion investment program in photovoltaic, battery electricity storage systems, and wind projects across Bulgaria, Hungary, North Macedonia, and Romania. The firm also advised on securing a EUR 315 million club loan facility led by the EBRD and backed by an InvestEU loss guarantee. DGKV, and reportedly A&O Sherman and PHH, advised the lenders.

In The Debrief, our Practice Leaders across CEE share updates on recent and upcoming legislation, consider the impact of recent court decisions, showcase landmark projects, and keep our readers apprised of the latest developments impacting their respective practice areas.

On 27 June 2025, the Assembly of North Macedonia adopted a new Electronic Communications Act (ECA). This landmark legislation represents a comprehensive overhaul of the country's digital regulatory framework, aligning it with the European Electronic Communications Code (Directive 2018/1972) (the "Directive") and the Gigabit Infrastructure Act (Regulation 2024/1309) (the "Regulation").

On 11 July 2025, Governmental Decision 437/2025 ("GD 437/2025") was published and entered into force. Through this piece of secondary legislation, the Moldovan Government has approved new rules governing the procedure for the prior examination and approval of investments of importance to state security. GD 437/2025 is intended to supplement the provisions of the recently updated FDI Law. But will this actually make things easier for existing and future investors?

Global business doesn’t stop at the border. Neither do contracts. Whether it’s a financing arrangement with a Dutch fund or a supply contract with a Romanian distributor, Moldovan companies routinely deal with foreign partners, and naturally, electronic signatures have become a tool of choice. But one simple question continues to surface: are electronic signatures issued by foreign trust service providers (TSPs not qualified in Moldova) treated the same as those issued locally?

This Legal Monitoring Report highlights key legislative developments in Moldova, including the launch of a grant program for tech start-ups, proposed excise duty reductions for small producers, extended paternity leave, enhanced protections for minor employees, regulation of temporary agency work, and time limits on meal voucher usage. Tax updates feature a new regime for freelancers, extended deductions for rural tourism and sports facilities, broader non-taxable income categories, and incentives for SMEs.

It’s mid-July, the summer is in full swing, and most of us are either on annual leave or eagerly counting down the days until we can finally unplug and recharge. That’s why I decided to dedicate this light, summer-friendly topic, perfect for reading in the shade at +35°C, to reminding us that the right to paid annual leave is not only one of the fundamental human rights, but also a necessary response to the lifestyle we lead.

Kinstellar, working alongside Noerr, has advised Strabag on the Romanian, Croatian, Czech, and Montenegrin aspects of its EUR 100 million acquisition of WTE Wassertechnik from EVN. Freshfields advised EVN.

The Ministry of Economic Development has conducted a public consultation on the draft Law on Class Actions. The primary reason for adopting a special law which regulates matters related to the collective protection of consumers is, above all, the harmonization of Montenegrin legislation with EU law, specifically with Directive (EU) 2020/1828 on representative actions for the protection of the collective interests of consumers and repealing Directive 2009/22/EC. The goal is to prevent and sanction mass violations of consumer rights by traders in the market, while also ensuring fair compensation for harmed consumers. In this text, we briefly present the most important amendments and innovations introduced by the draft Law on Class Actions.

SKJB Szybkowski Kuzma Jelen Brzoza-Ostrowska has advised Polish industrial real estate developer 7R on the sale of 7R BTS Bielsko-Biala West I, a 20,000-square-meter warehouse fully leased to Aluprof, to Accolade through a joint venture with Conseq. Norton Rose Fulbright advised Accolade.

Deloitte Legal has advised Value One on the sale of its Milestone student housing brand to Macquarie Asset Management. Greenberg Traurig and Schoenherr, working with PLMJ, advised Macquarie Asset Management.

CMS has advised Callstack shareholders Anna Lankauf, Mike Grabowski, Piotr Karwatka, and Tomasz Karwatka on an investment by Viking Global Investors.

Tuca Zbarcea & Asociatii has advised the Tasuleasa Social Association on the legislative process leading to the adoption of the Long-Distance Hiking Trail Law in Romania. Reff & Asociatii | Deloitte Legal reportedly advised the Tasuleasa Social Association as well.

White & Case and Bondoc si Asociatii have advised a syndicate of eight commercial banks and international financial institutions on the EUR 331 million financing of the second phase of the VIFOR wind farm project in Romania, currently being developed by Rezolv Energy, an Actis platform.

Wolf Theiss has advised the founder of Genesis College on an investment from Mozaik Investments. Filip & Company advised Mozaik Investments.

Contributed by Clifford Chance.

Contributed by Alrud.

The commercial legal markets of Central & Eastern Europe didn’t appear automatically. They didn’t develop in a vacuum. They were formed, shaped, and led, by lawyers – visionary, hard-working, commercially-minded, and client-focused individuals pulling the development of CEE’s legal markets along behind them as they labored relentlessly for their clients, their careers, their futures.

Former Kinstellar Associate Jelisaveta Folic has joined Max Bet as a Legal Associate.

Properly defined, provisional measures are awards or orders issued for the purpose of protecting one or both parties from the potential damage during the court process. Most often, provisional measures are intended to preserve a factual or legal situation in order to safeguard a right, the recognition of which is sought from the court having jurisdiction over the substance of the case. Additionally, provisional measures can extend beyond merely preserving the factual or legal status quo to require restoring a previous state of affairs or taking new actions.

NKO Partners has advised Sopharma on its full acquisition of Pharmanova. Radovanovic Stojanovic & Partners advised Pharmanova.

Kinstellar has advised Halyk Bank on a USD 237 million partnership with Click. Dentons reportedly advised Click.

Slovak lawyer Ivana Kollarova has become the Interim Deputy General Counsel at Pepco, based in Poland.

Kinstellar, working with Argo, has advised Altenova on its merger with Pyronova Group. KPMG Legal reportedly advised Pyronova.

ODI Law has advised GrECo on its acquisition of SIPOS Posredovanje Zavarovanj. CMS advised the sellers, Jurij and Majda Mravlja.

CMS, working with Clifford Chance, has advised UniCredit Group and Zagrebacka Banka on the EUR 550 million debt refinancing granted to Fortenova Grupa. King & Spalding reportedly advised Fortenova Grupa.

Although the Slovenian capital market is still in the developing phase and has not yet reached its full potential, recent updates to the regulatory framework and market infrastructure represent substantial improvements. Such developments are related to a) the remarkable growth of the investment funds industry (especially in the field of alternative investment funds), b) the entry into force of the Markets in Crypto Assets Regulation (MiCA), and c) the enactment of new legislation related to personal investment accounts.

Damla Aygun Yararca has become the Senior Director, Legal, Ethics, Compliance & Quality at Novo Nordisk Turkiye.

According to the Bulgarian–Turkish Chamber of Commerce and Industry (BULTİŞAD), as of August 2023, Turkish investments in Bulgaria have reached approximately €2.5 billion, generating over 15,000 jobs through more than 70 production facilities and 2,500 active companies[1].

CCAO has advised Ates Wind Power and its shareholders on the sale of a stake in the company to the Turkiye Green Fund. Ozbek advised the Turkiye Green Fund.

Sayenko Kharenko has advised Oschadbank as the coordinating bank of a consortium of Ukrainian state-owned banks in securing ownership of BFC Gulliver. Quinn Emanuel Urquhart & Sullivan reportedly advised Oschadbank as well.

Avellum and Hillmont Partners have successfully defended Argentem Creek Partners and Innovatus Capital Partners in a bankruptcy dispute against GNT Group member Olimpex Coupe International before Ukraine’s Supreme Court.

Avellum has advised Lignum Plast on a cross-border investment from Roodwild Participaties. SDM Partners, working with Von Boetticher, reportedly advised Roodwild Participaties.