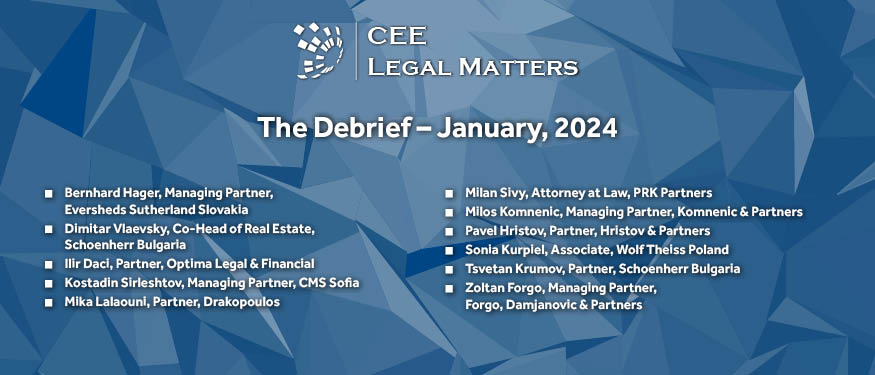

In The Debrief, our Practice Leaders across CEE share updates on recent and upcoming legislation, consider the impact of recent court decisions, showcase landmark projects, and keep our readers apprised of the latest developments impacting their respective practice areas.

This House – Implemented Legislation

Wolf Theiss Poland Associate Sonia Kurpiel and Drakopoulos Partner Mika Lalaouni start by highlighting recently implemented legislation in Poland and Greece, respectively. “Major changes for employers occurred in Poland,” Kurpiel says, underlining that “on November 17, 2023, the Ordinance of the Minister of Family and Social Policy of October 18, 2023, came into force, amending the ordinance on occupational safety and health at work in workplaces equipped with screen monitors.” She emphasizes that employers have six months to bring existing workstations into compliance with the new regulations.

According to Kurpiel, the changes are of significant importance to employers hiring remote employees, “as employers must provide desktop monitors or laptop stands to employees who use a portable computer system and use it for at least half of their daily working hours. In addition, a workstation equipped with a portable computer system must be equipped with an additional keyboard and mouse. Another new requirement is to equip employees with seats with regulated armrests.” Additionally, “a further change applies to employees who have a visual defect,” she explains. “Until now, employers were required to provide employees with glasses if the results of an eye examination conducted as part of preventive health care showed the need for them while working at a monitor. The new regulations require employers to provide employees with glasses as well as contact lenses.”

In Greece, “Law 5066/2023 entered into force on November 14, 2023 (Law 5066),” according to Lalaouni. It inter alia “transposes Directive EU 2021/2101 amending Directive EU 2013/34 as regards disclosure of income tax information by certain undertakings and branches into Greek law and updates national legislation on companies’ publicity obligations.” According to her, “Law 5066 aims to promote financial and corporate transparency, ensuring the full functioning of both the Greek market and the internal market of the EU, providing equivalent safeguards throughout the EU for the protection of investors.”

Lalaouni explains that “according to Law 5066, multinational groups, and where relevant, certain standalone undertakings, are obliged to publicly report income tax information where they exceed a certain size, in terms of the amount of revenue, over a period of two consecutive financial years, depending on the consolidated revenue of the group or the revenue of the standalone undertaking, unless the above entities fall within the exceptions set out in the relevant law provisions.” In case of non-compliance, she notes that “fines ranging from EUR 10,000 to 100,000 may be imposed on members of the administrative, management, and supervisory bodies.” Furthermore, Lalaouni says that “Law 5066 obliges capital companies of the non-financial sector which receive financing from credit institutions lawfully operating in Greece and listed companies to submit their financial statements to the Bank of Greece.”

This House – Under Review

CMS Sofia Managing Partner Kostadin Sirleshtov points to potential recent changes to Bulgarian renewable energy legislation, particularly focusing on new wind projects and battery storage solutions. According to him, “the second attempt of the Bulgarian Parliament to pass the Offshore Wind Act started at the beginning of December 2023, and will be closely watched by the investment community, as the Ministry of Energy has already received the first application for a 1,000+ megawatt and EUR 2+ billion commitment.”

This House – The Latest Draft

PRK Partners Attorney at Law Milan Sivy highlights that an “important and complex amendment to the Czech ‘Mergers’ Act (i.e., Act No. 125/2008 Coll., on Transformation of Business Companies and Cooperatives, as amended) is being prepared. The primary objective of the proposed amendment is to incorporate requirements of EU Directive 2019/2121 concerning certain transformations with cross-border elements (cross-border transfer of registered seats, mergers, and separation) into the Czech legal order.” However, Sivy also underlines rather controversial parts, with “some changes of the amendment comprising the possibility of executing a demerger through a spin-off of a listed joint-stock company with an unequal share exchange ratio and a demerger through spin-off with the termination of minority shareholders’ participation with the consent of 75% of the votes of the shareholders present at the general meeting (under certain additional conditions).”

Schoenherr Bulgaria Partner Tsvetan Krumov highlights that “in November 2023, the Bulgarian Ministry of Finance completed a two-year project of drafting a close-out netting legislation, supported by the EBRD and legal consultants that is expected to be soon submitted to the Parliament.” Krumov further stresses that the purpose of this long-awaited draft is “to increase the legal certainty around lots of transactions where close-out netting is used as a standard mechanism for credit risk reduction – as derivatives, repos, securities lending, and other securities financing transactions.”

Eversheds Sutherland Slovakia Managing Partner Bernhard Hager notes that in Slovakia, “a draft on so-called ‘to-go zones’ confused many clients.”

In the Works

Komnenic & Partners Managing Partner Milos Komnenic reports Montenegro has seen notable 5-star hotel-related project developments recently. “There is ongoing development of a number of large-scale hotels,” he notes. “These include the Montis Mountain Resort in Kolasin, Galeb in Ulcinj, and Riviera Montenegro in Budva. All these investments are over EUR 50 million and are at different stages of development.” Komnenic also mentions that “due to the economic citizenship program and significant developments in the south and north of the ski centers in Montenegro, 25 larger hotels are currently under various stages of development of which all projects are 5 and 4 stars. Notably, major operators such as Rixos, Swiss Hotel, Iberostar have entered the Montenegrin market, resulting in a substantial boost to the hotel and real estate market.” Additionally, “landmark projects such as Lustica Development and Porto Montenegro continue to develop with a successful sale and expected pricing of even EUR 15,000 per square meter for certain types of property, while Portonovi is also having a number of sales as this project is fully developed.”

Optima Legal & Financial Partner Ilir Daci adds that, in Albania, the state-run KESH aims to lead renewables’ development “with a project for the construction of a new 50-megawatt solar plant in Belsh, central Albania.” According to him, the solar plant just got the green light for financial support from the European Commission.

The most notable project in Hungary in terms of M&A, according to Forgo, Damjanovic & Partners Managing Partner Zoltan Forgo, “is clearly the purchase of the Budapest Airport by a consortium, which includes the Hungarian State.” According to him, the transaction is expected to be signed by the end of December, as “the European Commission has already approved the transaction in a simplified procedure.” The current owners of the Budapest Airport, according to Forgo, are reported to be Germany’s Avialliance GmbH (55,4%), Malton – a subsidiary of Singapore’s State investment fund, GIC (23,33%), and the Canadian Pension Fund Caisse de depot et placement du Quebec (21,23%). He adds that the purchaser consortium is reported to consist of Corvinus Zrt., a 100% Hungarian state-owned vehicle, and France-based Vinci Airports. “It is also expected that Quatar’s state investment fund participates either as a financial or strategic investor,” Forgo says. “The purchase price is expected to be in the range of EUR 4-5 billion.” According to him, “by making this purchase the Hungarian State may fulfill a long-awaited desire of the Hungarian Government to have a majority control over the Budapest Airport.”

Lastly, over the last month, according to Sirleshtov, in Bulgaria, “Lukoil announced that it is selling the largest Bulgarian company – Burgas refinery,” noting that the transaction is expected to be worth billions of euros.

Done Deals

In the meantime, according to Sirleshtov, “greenfield solar investments were on the rise with Astronergy completing its second and third acquisition in Bulgaria in 2023 thus bringing its capacity in Bulgaria to over 200 megawatts.”

Sivy also points to major recent deals in the Czech Republic, noting that “the group Kofola CeskoSlovensko has acquired a controlling stake in the Pivovary CZ group. The transaction is subject to the approval of the antitrust authorities, and completion is expected early next year.”

Daci underlines that Albania aims to “emerge as a regional powerhouse of large-scale renewable projects,” and “one such showcase project is Voltalia’s 140-megawatt Karavasta, promoted as the largest solar power plant in the Western Balkans, which, as announced yesterday, is now fully built and ready to generate power.”

Hristov & Partners Partner Pavel Hristov adds that while recently “several deals have been aborted or frozen for the future by the potential buyers” in Bulgaria, “most of the deals and funding rounds, however, were closed or continue to close. Recently, US-Bulgarian startup LucidLink raised USD 75 million in Series C funding and the green tech start-up Plan A closed a USD 27 million Series A funding round.” In parallel, Hristov adds that “the competition authority delayed beyond the statutory term of review major cross-border merger proceedings, thus creating uncertainty and frustrating the parties. This includes Advent International/myPOS and Emirates Communication/PPF Telecom Group merger cases, pending since October 9, 2023.”

Regulators Weigh In

Krumov says that “the growth of crediting in Bulgaria continues with interest rates being kept at record low levels,” adding that the Bulgarian National Bank has been gradually increasing the “base interest rate.” As of December 1, 2023, he says, “the said index is 3.80% per annum,” and “the Bulgarian banking sector continues to maintain surprisingly low interest rates (significantly below the above figure), a trend that is divergent from many Western European nations.”

Daci also notes, that in Albania, “the regulatory authority reconfirmed the feed-in tariff of LEK10/kilowatt-hour for next year,” on December 15, 2023.

In Related News

Komnenic also highlights the ongoing public discussions on the Construction and Tourism Law. After the recent elections, he says, “the new government plans to review and revise these laws in accordance with its policies, with the expectation of significant changes in the second quarter of 2024.” The major hope, according to him, is that the “new government will revise and modify restriction imposed by the previous government whereas VAT credit was not allowed on residential properties, which also introduced legal concerns in respect of other types of real estate.”

Schoenherr Bulgaria Co-Head of Real Estate Dimitar Vlaevsky draws attention to the recent report made by “one of the largest Bulgarian banks – Unicredit Bulbank on the accessibility of residential properties,” saying that “according to the report the prices of the residential properties are unacceptable compared with the income of the Bulgarians.” Vlaevsky notes that “the report drew heavy criticism from the market and especially from the Bulgarian National Bank since it indirectly alleged that the central bank did not undertake any actions to increase interest rates (currently the average interest on mortgage loans for consumers is 2.6%). According to the National Bank, the interest rates in Bulgaria are low due to the high amount of deposits and profits of the Bulgarian banks (the banks have a profit of more than EUR 1.5 billion by the end of October).”

Lastly, Daci reports that “at the end of this year, the obligation of public service set by governmental decree as an emergency measure due to the energy crisis caused by the war in Ukraine expires.”

This article was originally published in Issue 10.12 of the CEE Legal Matters Magazine. If you would like to receive a hard copy of the magazine, you can subscribe here.