In the audit practice of the Hungarian Tax and Customs Administration (HTA), the audit of transfer pricing is gaining importance. Moreover, the relevant regulations are becoming more complex with each passing year. As the deadlines for transfer pricing documentation approach, it is worth reviewing what hidden pitfalls should be avoided when preparing documentation and providing data.

Dragos Doros Joins Artenie Secrieru & Partners To Launch Artenie, Secrieru, Doros Tax

Former Eversheds Sutherland Romania Tax Partner Dragos Doros has joined the Artenie Secrieru & Partners law firm in Bucharest to launch their sister operation – Artenie, Secrieru, Doros Tax – as Managing Partner.

Community Financing – Dying Opportunity or the Future of Fundraising?

One of the measurable success stories of the fintech revolution is how donation and subscription-based community financing has become an alternative to traditional fundraising methods such as classical bank financing or venture capital investments. From this rapid development, it follows that there is a less uniform picture in the public consciousness about the phenomenon of "crowdfunding." How many forms are there? Which ones are regulated? Who are the actors in the process? What regulations apply to it? How are they taxed? Among many clarifications to be made, the main question, however, is whether specialized crowdfunding service providers for this purpose will emerge in Hungary as well.

A New Attempt by State Authorities Through Criminal Law Instruments To Cover the Budget Deficit and State’s Inability To Collect Taxes

Starting with May 16, 2024, the Law no. 126/2024 on some measures to strengthen the capacity to combat tax evasion, as well as to amend and supplement some normative acts, enters into force.

ECJ Lends a Helping Hand to Non-Established Persons Seeking VAT Refund

According to the decision of the Court of Justice of the European Union of 16 May 2024 (C-746/22), the Hungarian rule that does not allow foreign taxpayers in VAT refund cases to submit their documents even in the appeal procedure is contrary to EU law. We have summarised the key lessons learned from the case which was handled by our office.

LSW Expands with Eight-Partner Team Hire from B2RLaw

LSW Bienkowski, Laskowski, Lesnodorski, Melzacki and Partners has announced it hired eight new partners – Filip Badziak, George Havaris, Marcin Huczkowski, Piotr Leonarski, Krzysztof Marzynski, Adam Piwakowski, Aleksandra Polak, and Piotr Szelenbaum – all coming from B2RLaw, alongside a group of associates, administration, and marketing support.

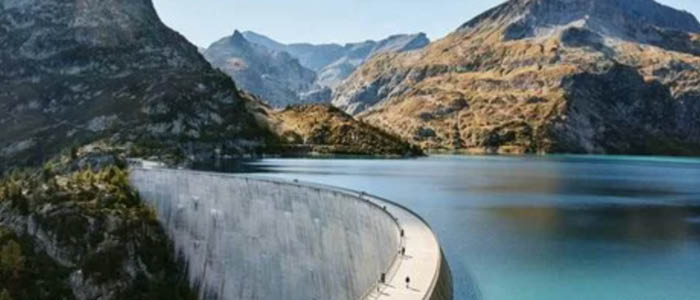

Domokos Neagu Sarbu Successful for Alpiq in Dispute with Romanian Tax Authority

Domokos Neagu Sarbu has successfully represented Alpiq in a tax dispute with the Romanian tax authority in a case that ultimately required the input of the Romanian Supreme Court.