On 2 June 2025, the European Commission (“EC”) imposed a substantial EUR 329 million fine on Delivery Hero and Glovo for their involvement in a cartel in the online food delivery sector.

Karanovic & Partners Advises Paysera on Securing EMI License in North Macedonia

Karanovic & Partners has advised Paysera North Macedonia on obtaining an Electronic Money Institution license.

New Rules on Ultimate Beneficial Owner Registration in Serbia

Effective 1 October 2025, amendments to the Law on the Centralised Records of Beneficial Owners (UBO) in Serbia will introduce important new obligations for a broader range of entities.

NBS Adopts New MREL Rules

The National Bank of Serbia (“NBS”) adopted the new Decision on the Minimum Requirement for Capital and Eligible Liabilities of a Bank (“New MREL Decision”), as part of a package of new or amended bylaws following the latest amendments to the Law on Banks. The New MREL Decision shall replace the existing decision of the same name (“Existing MREL Decision”) and shall apply starting from 1 October 2025.

Albania Adopts New Instruction on the Processing of Health and Genetic Data

As part of the broader effort to harmonise national legislation with the EU General Data Protection Regulation, the Albanian Data Protection Commissioner issued Instruction No. 2, dated 30 April 2025 (Instruction No. 2), on the protection of personal data in the health sector. This Instruction repeals the previous 2020 framework and establishes a comprehensive set of rules governing the collection, use, and disclosure of health and genetic data.

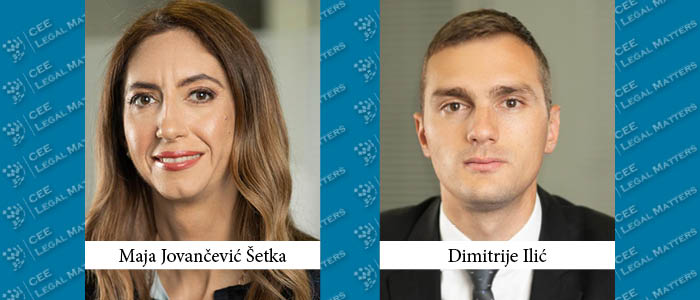

Serbia's Protests, Slowdown, and First Issuance: A Buzz Interview with Maja Jovancevic Setka of Karanovic & Partners

Serbia’s economy remains stable despite slower growth, with signs of renewed M&A activity, ongoing regulatory reforms, and progress in renewables and the capital market, according to Karanovic & Partners Partner Maja Jovancevic Setka.

North Macedonia Adopts New Law to Regulate Seasonal and Occasional Employment

In a progressive move towards formalising seasonal and occasional work, the Assembly of North Macedonia has adopted a groundbreaking law to regulate temporary employment across key sectors. This legislative development aims to streamline the hiring process for temporary workers while ensuring they receive essential social security benefits.

Bank of Albania Tightens Marketing Rules for Banks and Financial Institutions

The Bank of Albania has introduced a new regulatory framework on marketing and advertising by financial institutions, significantly enhancing consumer protection and transparency in the financial sector. The changes, enacted through Decision No. 11, dated 5 February 2025, amend the Regulation “On Transparency for Banking and Financial Products and Services” and enter into force on 1 May 2025.

The Corner Office: The Next Big Thing

In The Corner Office, we ask Managing Partners at law firms across Central and Eastern Europe about their backgrounds, strategies, and responsibilities. This time around, we asked: For 2025, what is the one sector or industry in the country that shows the most promise for growth, and why?

Ilej & Partners and Wolf Theiss Advise on Cirtuo's Sale to Coupa

Ilej & Partners, in cooperation with Karanovic & Partners, has advised Cirtuo on the sale to Coupa. Wolf Theiss, working with Kirkland & Ellis, advised Coupa on the deal.

New Amendment Eases Data Transfer Rules from North Macedonia to NATO Nations

On 14 May 2025, significant changes were made to North Macedonia’s personal data protection legislation. The Assembly of the Republic passed an amendment to expand the nations where personal data can be shared freely, without facing third-country transfer restrictions.

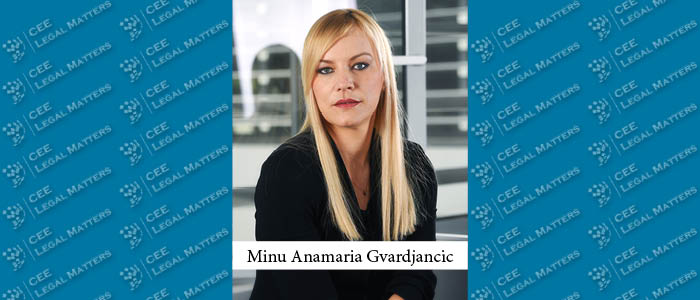

Hot Practice in Slovenia: Minu Anamaria Gvardjancic on Ketler & Partners' Dispute Resolution Practice

Consumer-focused litigation, especially relating to Swiss loan credit contracts, has driven significant growth in dispute resolution practices in Slovenia since 2022, according to Ketler & Partners, member of Karanovic Partner Minu Anamaria Gvardjancic. With the courts adopting a very proactive stance and wide interpretation of the impact of EU case law increasingly asserting consumers’ rights, disputes are expected to continue expanding in the coming months.

Macedonian Competition Commission Stepping Up Its Enforcement Efforts

In the last few months, the Commission for Protection of Competition of the Republic of North Macedonia (the “Commission”) has stepped up its enforcement efforts of antitrust rules and food supply chain practices in the country.

Karanovic & Partners and Harrisons Advise on BIG CEE's EUR 72 Million Financing from the EBRD

Karanovic & Partners has advised BIG CEE on a EUR 72 million financing – part of a EUR 100 million package from the European Bank for Reconstruction and Development – to expand its retail portfolio across the Balkans. Harrisons advised the EBRD.

RTPR, Karanovic & Partners, White & Case, and Kinstellar Advise on Sale of Regina Maria Group to Mehilainen

RTPR and Karanovic & Partners have advised MidEuropa on the sale of Regina Maria Group to Mehilainen. White & Case advised Mehilainen. Kinstellar advised Blue Sea Capital on the sell-side as well. Reportedly, A&O Shearman's London office also advised MidEuropa while Bondoc & Asociatii also advised Mehilainen.

North Macedonia Becomes a Member of SEPA: Changes in Financial Payments and Transactions

On 6 March 2025, the European Payments Council officially accepted North Macedonia’s application and included North Macedonia in the Single Euro Payments Area (“SEPA”). With this, North Macedonia became the 39th member of SEPA.

Montenegro Enacts New Laws on Investment Funds to Align with EU Standards

Montenegro has enacted two new laws that significantly reform its investment fund sector.

Albania Moves Forward with Draft Law to Establish the Development Bank of Albania

The Minister of State for Entrepreneurship and Business Climate has introduced a draft law for the establishment of the Development Bank of Albania (“DBA”), a specialised public financial institution designed to facilitate financing for small and medium enterprises, start-ups, and underfinanced sectors. The bank is also envisioned as a key player in promoting exports of domestic products and services, as well as supporting public projects and various infrastructure developments.